Now that we understand you should use money from your Roth IRA to get a house, let us explore no matter if you will want to. Same as most top financial conclusion, you can find pros and cons so you’re able to delivering this process. It is never a one-size-fits-every answer.

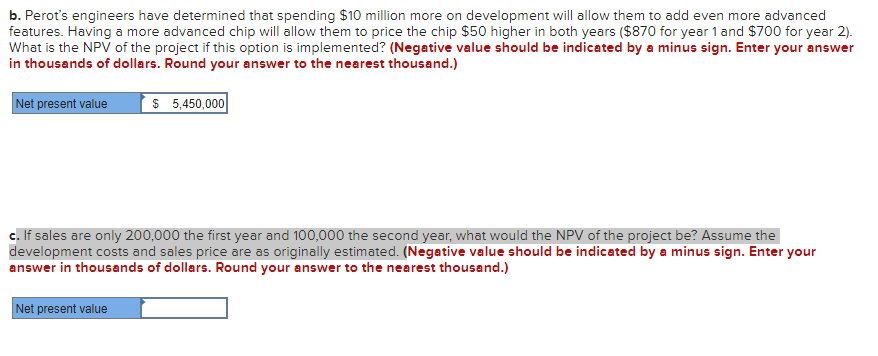

If you are considering having fun with funds from their Roth IRA to shop for a house, here are some issues that my work call at your own favor…

Zero Punishment or Taxes

We covered it prior to but it is the key reason individuals consider scraping its Roth getting deposit money… Roth IRA efforts would be taken when, along with your income up to $10,000 to own an initial time home buy. So long as it has been no less than five years as the first sum, you are absolve to just take currency aside regarding family.

You are going to Avoid PMI

In the event the making use of your Roth IRA makes you put 20% upon your property purchase, it can help that avoid PMI, or personal home loan insurance policies. After you put down below 20%, you may be viewed as a beneficial riskier borrower.

Normally, PMI will set you back as much as 0.6 to one.8% of your amount borrowed each month, dependent on your credit rating or any other financing points. This may improve your payment somewhat! To stop PMI can save you from expenses several more hundred or so bucks each month for several age.

Shorter Financing, Less Desire

A different sort of advantageous asset of making use of your Roth IRA to boost your down percentage when buying a home is boosting your guarantee condition. That it lowers the mortgage amount, which often decreases the focus you only pay. Preferably, immediately following purchasing your home and you can waiting on hold so you’re able to it having good long time, you will want to experience important appreciate. If you’re primary residences aren’t the best expenditures, average enjoy for real home is approximately cuatro% a year.

Never to appear to be Eeyore, but it is time for you to defense this new disadvantages out of tapping your own Roth to have a home get. Before going draining your own Roth IRA to find a home, you really should believe each one of these very serious downsides…

Charges May possibly occur

When you take income out of your Roth IRA, your top double (and you can triple!) look at the mathematics. When you get the fresh quantity wrong and you may withdraw more $ten,000 during the income, otherwise withdraw earnings in advance of one to 5 12 months hold off period was upwards, you might be into the link to own taxation effects.

It happens more frequently than do you consider! Anyone pull out money, convert Old-fashioned in order to Roth IRAs, to make moves with their currency that spark significant taxation effects. It is important to make sure you happen to be following the all Internal revenue service laws in advance of fooling with old-age profile before you reach retirement age.

Overlook Prospective Income tax-free Earnings

Perhaps the greatest drawback of employing money from your Roth IRA to shop for a property are lost all that tax-100 % free increases out-of investment!

By far the most effective element of old age expenses is actually compound returns. This is how your wages end up, nowadays the individuals productivity are put to be effective in the market for your requirements toopounding efficiency has actually Wisconsin direct lenders installment loans appropriately already been called the eighth inquire of the globe. Incase all of that increases is actually tax-totally free, it is a great deal more effective after you reach old age..

By using money from your own advancing years membership early, you can easily miss out on every material focus you may be making thereon dollars. It is not chump change! For folks who spend money on list funds, your finances more than likely increases all the ten years. So everything features on your Roth IRA now could potentially feel Twofold if you leftover it invested in lieu of pull it away. Please remember, the audience is these are bucks that you’ll be able to draw down tax free afterwards!