Owning a home has some benefits. You get to prefer when to correct it up, just how to color and you may decorate it, and you’re not susceptible to a landlord. But there is however an advantage to help you buying your home: you can use your residence equity to obtain financing and that means you have access to resource when you need it.

You’ve probably heard about HELOCs, or house collateral personal lines of credit. This means that, it is that loan protected by your home.

Let us discuss exactly how a good HELOC performs and you will if or not with your household equity so you can borrow money is a great option for you.

What’s Home Equity?

Just before we glance at how a beneficial HELOC really works, we should instead explore domestic guarantee which means you understand what you are getting into the.

Home guarantee is the newest value of your house minus any a good loans (i.age., your financial). Here’s what your often learn about when people relate to strengthening collateral with a home. The target is to pick a home and also it enjoy inside well worth because you consistently make your home loan repayments.

Simply put, it’s how much you really own in your home. The remainder is where far the financial institution has (i.age., how much cash you took out having home financing). Therefore, your home security grows because you pay off a lot more of your home loan or since your house develops in really worth.

Particularly, for individuals who purchased your home to own $400,000 with a $three hundred,000 mortgage (the amount your debt) and your property’s really worth has gone up to $five hundred,000, that implies you have got $2 hundred,000 in home guarantee which can be used so you’re able to borrow money against: $100,000 down once you purchased the house + $100,000 boost in value.

How come a great HELOC Functions?

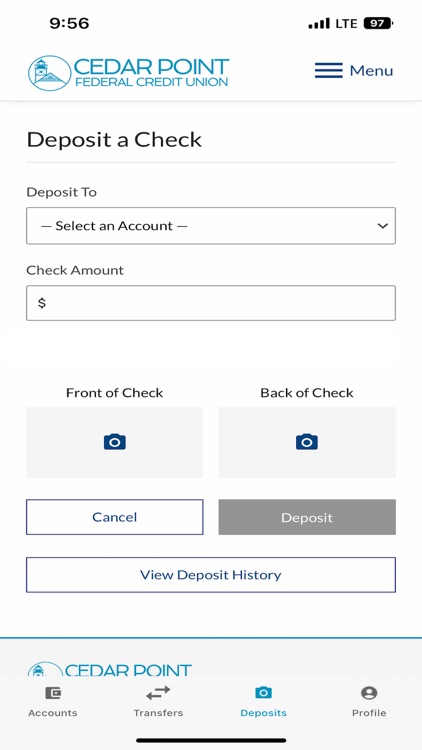

Property guarantee credit line is like a personal personal line of credit: you can access bucks (credit) that can be used as you need they. Really the only variation would be the fact that have a good HELOC, you place your property right up just like the security.

New HELOC may come that have a maximum amount as you are able to obtain based on how much equity you really have in your home. You’ll be able to favor exactly how much of your currency your obtain just in case your obtain they. You will never feel charged one desire otherwise use the money.

Because you might be putting your home up as the collateral, the lending company is ready to financing you more money on an effective straight down interest. Exactly why are a good HELOC glamorous would be the fact its just like good mastercard. You’ve got the capability to borrow funds when you need it without the inquiries. Make use of your HELOC to own renovations or even for individual grounds.

Masters & Cons of HELOCs

- You have access to a whole lot more money than along with other loans. Because the you might be borrowing money in line with the equity of your home, online personal loans NJ you probably get access to far more borrowing.

- You merely borrow what you would like. A major advantageous asset of a great HELOC is you can supply the money when you need it, in lieu of needing to take-out a lump sum loan.

- HELOCs features lower-rates. Since your home is security, the lending company could possibly offer you a lower interest than just if you were taking out an unsecured loan.

- You may have flexible installment choices that have good HELOC. You could spread out the commission terminology for approximately 31 ages having a beneficial HELOC. Inside the draw period (usually the basic 10 years), possible just need to make interest repayments.