A few legislative treatments per possessions sequence and you will landholding accountability for the accessibility property by personal household members is actually critical for the data. This type of interventions through the Intestate Series Legislation 1985 (PNDCL 111) and also the Direct regarding Family relations Liability Laws 1985 (PNDCL 114) , having possible significance so you can belongings supply, together with even at level of the littlest relatives equipment. Within arrangement, ownership of the house reverts of private control (of ily once the a business unit . indexed that no person normally allege sole ownership in order to instance a good home. Its however debated that if your family functions as an excellent collective party, the family tool while the home held by the friends while the commonwealth can be put once the buffers against stressful changes [75,76], including allowing an associate to make use of the fresh new land once the collateral security having fund. In this case but not, it is necessary in order to discuss new expectations and requires of each and every loved one [77,78].

Because of the separated position on implications from belongings tenure membership courses on the books fundamentally, this paper tries to provide understanding regarding Dagbon personal system from inside the Ghana in order to explicate the issue on the ground. This employs about realisation that inconsistencies have been popular inside the fresh new sales literature [79,80], which have implications based on how programs to own local belongings registration are effective in different societal structures. In this regard, analysing exactly how actors within other public assistance take part in belongings tenure membership programmes plus the implications of its engagement is of good use. The brand new key attract with the report are ergo to explore brand new nature and you can figure out of metropolitan assets places regarding Dagbon city in the northern Ghana, and how they food in making use of some residential property-dependent funding tool. Particularly, i concentrate on the skill away from arrived possessions to incorporate accessibility so you can borrowing from the bank and you may finance money throughout the houses plan.

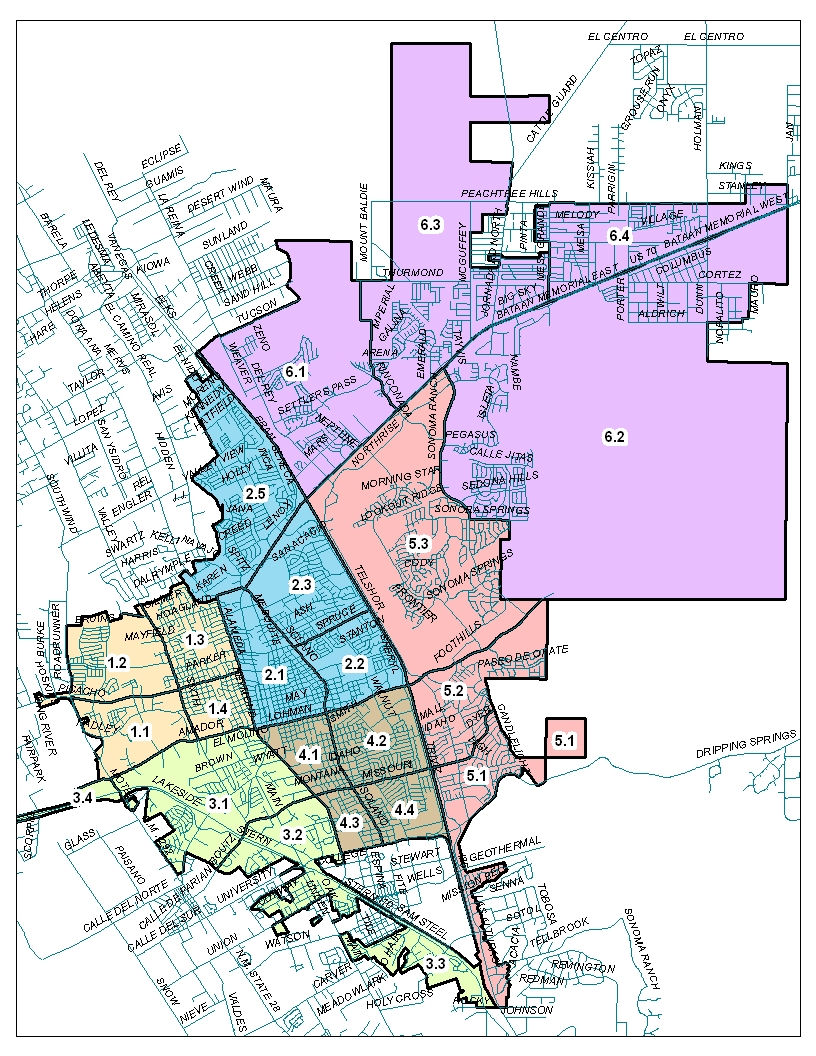

4.step one. Research urban area dysfunction

The study was held regarding Tamale Urban Urban area (TMA) (discover Fig. 1 ). Tamale is the regional resource of your own Northern Region of Ghana. The fresh new native individuals of Tamale could be the Dagomba ethnic group and that for centuries shaped among oldest kingdoms in the region titled Dagbon, with its antique Overlord when you look at the Yendi. Tamale, the main city of the fresh Dagombas, is the third-prominent town into the Ghana and you can an evolving hotspot having investment during the Western Africa. Tamale serves as the brand new management and you can industrial center for the North Region plus doubles given that higher urban, monetary, social, political, and you can monetary resource of Northern Part (find Fig. 1 ). The metropolis hub from TMA machines several regional, local, and worldwide finance institutions and numerous international and local nongovernmental enterprises. Dagbani ‘s the native vocabulary of Dagbon.

To get over this complications, the fresh books implies that a sustainable houses capital method is crucial [, , ]. Eg a facility is additionally more requiring inside Around the globe Southern places such Ghana, where emigration towards the metropolitan areas enjoys weighed down houses institution, leading to sprawling slums [13,14]. Regardless if obtainable borrowing from the bank possibilities keeps generally started regarded because the a great power when you look at the making sure renewable construction techniques, certain reasons for having the newest restricted move out-of lender credit to help you domiciles and you may providers has been a layout in different research studies for the such countries. From inside the Ghana the trouble might have been duly accepted. Aryeetey seen the Nevada title loan new discrepancy involving the reluctance away from creditors so you can generate borrowing from the bank available since domiciles and you may people mostly use up all your adequate appropriate equity to help with the funds. Offered analytics reveal that, inside Ghana, an estimated 79% off micro and 83% out-of brief-measure enterprises is actually borrowing from the bank restricted, compared with 62% and you can 68% respectively for the Malawi (ibid.:164). Therefore, within the a breeding ground in which potential dealers run out of equity to help with borrowing purchasing homes plans, private discounts, offering away from possessions, and you can remittances out-of relatives overseas are very part of the-stand of financial support to own private property construction and you may commands [twelve,16]). As a result of the inadequate finance raised from these offer, in most cases it entails more 10 years to do the design of one assets [a dozen,17].

4. Information and techniques

The job out of lends support to that particular doctrine. Certainly almost every other methods ,talks about how the Bodies from Poultry working casing financialisation using the fresh new legislation; creating economic tissues you to definitely increased conjecture by residential and you will internationally financial support into the homes and you will housing due to the fact possessions; enclosing public house and you may exploiting relaxed form of tenure; and then make possessions regarding homes and you may construction because of the developing money-discussing metropolitan regeneration programs; and utilizing coercive courtroom and penal force to help you outlaw everyday invention, and to inhibits resistance to condition-led advancement jobs.

Just what seems missing inside earlier in the day knowledge might have been the newest micro-top, effects from family members-help mortgage agreements, including using intra-nearest and dearest asset since the collateral from inside the getting loans for money. In fact, inside the custoily-assist home loan arrangement are a method which was employed for many years into the traditional circles into the Ghana through the days of personal otherwise loved ones you would like. Even after the promulgation of your Intestate Succession Rules, 1985 (PNDCL step one 111) , experience means that Ghanaian families might not follow the conditions off the brand new Intestate Law when controling this new mind-gotten property of a dead father, fearing it can evaporate their property . Particular parents choose remaining the house for the a pool on the whole family, especially in the actual situation out of belongings. That is particularly the instance if the piece of assets bequeathed is relatively smaller than average never be easily mutual except of the attempting to sell the newest property and you will publishing the newest continues. Although not, posting eg home is problems in the north Ghana, in which Complete Virility Rates is actually high, and you will polygyny ‘s the norm . Polygynous equipment with assorted uterine group mean a premier reliance ratio. The outlook one to fragmentation of the home this kind of issues you will definitely devalue their monetary advantages encourages household to save particularly property from inside the the newest pond. The fresh new advent of certified financial reinforced new traditional usage of particularly possessions.

Following this direction, this new and you can, later , analyses of assets are key markets ideas inside their help towards the individualisation of assets inside ethical limits . These concepts preceded people arguing new natural inevitability of individualisation just like the better as the people with the monetary advisability out of individualisation. Speaking of, however, go against prominent possessions theorists who do perhaps not come across individualisation because a stimulant to own creativity.

It is reasonably obvious on the literature examined one to, even in the event plenty of scholarly works has been over for the the main topic of house as the collateral, you will find not many work particularly looking into intrafamily quick devices (including polygynous parents with uterine products) as well as how the usage of the latest commonwealth is negotiated within the service men and women seeking utilize this loved ones possessions since the collateral having loans. Certainly one of almost every other factors, the purpose of this study hence is to explore the new intricacies on the discussion of your commonwealth just like the collateral for individuals, just how that is expressed, and what the results are if there is default out-of loan payment and you will what is done to recover the new told you property.